Clark Wealth Partners for Beginners

Wiki Article

Not known Incorrect Statements About Clark Wealth Partners

Table of ContentsSome Ideas on Clark Wealth Partners You Need To KnowClark Wealth Partners Can Be Fun For AnyoneThe Single Strategy To Use For Clark Wealth PartnersSome Known Factual Statements About Clark Wealth Partners The Clark Wealth Partners Diaries

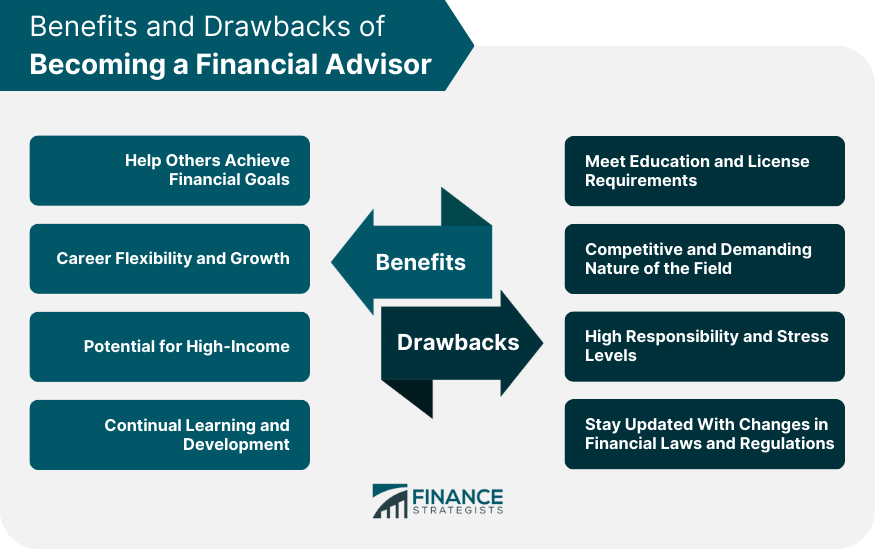

Just placed, Financial Advisors can take on component of the responsibility of rowing the boat that is your monetary future. A Financial Expert need to collaborate with you, not for you. In doing so, they must act as a Fiduciary by putting the ideal interests of their clients above their very own and acting in excellent faith while offering all appropriate realities and staying clear of conflicts of rate of interest.Not all connections are effective ones. Prospective negatives of working with a Financial Advisor include costs/fees, quality, and potential desertion.

Absolutely, the objective must be to seem like the suggestions and solution got are worth more than the expenses of the connection. If this is not the case, then it is an adverse and therefore time to reevaluate the relationship. Disadvantages: Top Quality Not all Monetary Advisors are equal. Simply as, not one consultant is ideal for every possible customer.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

A client should constantly be able to address "what occurs if something takes place to my Financial Expert?". Always appropriately vet any type of Financial Expert you are contemplating working with.If a specific location of expertise is needed, such as functioning with exec compensation plans or setting up retirement plans for tiny organization proprietors, discover consultants to interview that have experience in those sectors. Functioning with a Monetary Consultant ought to be a partnership.

It is this type of initiative, both at the begin and through the partnership, which will certainly help emphasize the advantages and hopefully minimize the negative aspects. The function of a Financial Consultant is to help customers establish a strategy to meet the monetary goals.

That work includes costs, occasionally in the forms of property management costs, commissions, intending fees, financial investment product fees, etc - Clark Wealth Partners. It is essential to recognize all charges and the framework in which the advisor operates. This is both the obligation of the advisor and the client. The Financial Expert is liable for providing value for the costs.

The Best Guide To Clark Wealth Partners

Preparation A service strategy is important to the success of your business. You require it to recognize where you're going, exactly how you're arriving, and what to do if there are bumps in the road. A great economic advisor can put with each other a comprehensive plan to aid you run your business a lot more successfully and prepare for anomalies that emerge.

Lowered Anxiety As a company owner, you have great deals of points to stress around. A good monetary expert can bring you tranquility of mind knowing that your financial resources are getting the interest they require and your cash is being spent intelligently.

Often service owners are so focused on the daily work that they shed view of the huge picture, which is to make a profit. A financial expert will certainly look at the general state of your financial resources without getting feelings involved.

Clark Wealth Partners for Dummies

There are lots of benefits and drawbacks to think about when hiring a monetary advisor. Firstly, they can offer valuable expertise, specifically for complex monetary planning. Advisors deal personalized methods customized to individual goals, possibly leading to much better economic outcomes. They can likewise alleviate the tension of taking care of financial investments and monetary choices, giving satisfaction.

The expense of working with a monetary consultant can be considerable, with costs that may impact total returns. Financial preparation can be overwhelming. We suggest talking to a monetary advisor. This free tool will certainly match you with vetted experts who offer your location. Right here's exactly how it functions:Respond to a couple of very easy questions, so we can locate a match.

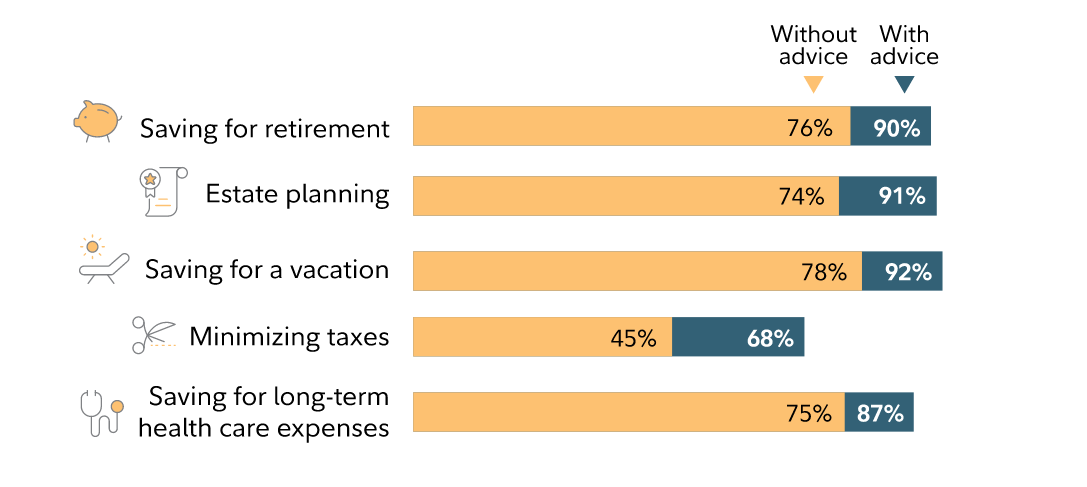

It just takes a couple of mins. Inspect out the consultants' profiles, have an introductory contact the phone or introduction face to face, and pick that to work with. Find Your Advisor Individuals transform to monetary advisors for a myriad of reasons. The possible advantages of employing an advisor include the competence and understanding they offer, the customized advice they can provide and the lasting self-control they can inject.

The Definitive Guide for Clark Wealth Partners

Advisors are skilled specialists who remain updated on market patterns, financial investment techniques and economic regulations. This understanding allows them to offer understandings that could not be readily obvious to the ordinary individual - https://directory9.biz/details.php?id=311962. Their experience can assist you navigate complicated financial circumstances, make informed choices and possibly surpass what you would certainly accomplish on your very ownReport this wiki page